2.8 million Coloradans – nearly half the population – have chosen credit unions as their financial services providers.

Members use their credit unions to save money, obtain loans, credit cards, and other financial tools. What makes credit unions different is their not-for-profit, member-owned, cooperative structure. That means they reinvest their earnings in their members, delivering value such as lower loan rates, higher savings yields, and lower fees.

Members use their credit unions to save money, obtain loans, credit cards, and other financial tools. What makes credit unions different is their not-for-profit, member-owned, cooperative structure. That means they reinvest their earnings in their members, delivering value such as lower loan rates, higher savings yields, and lower fees.

The Important Impact of Colorado Credit Unions. Cooperative. Local. Trusted.

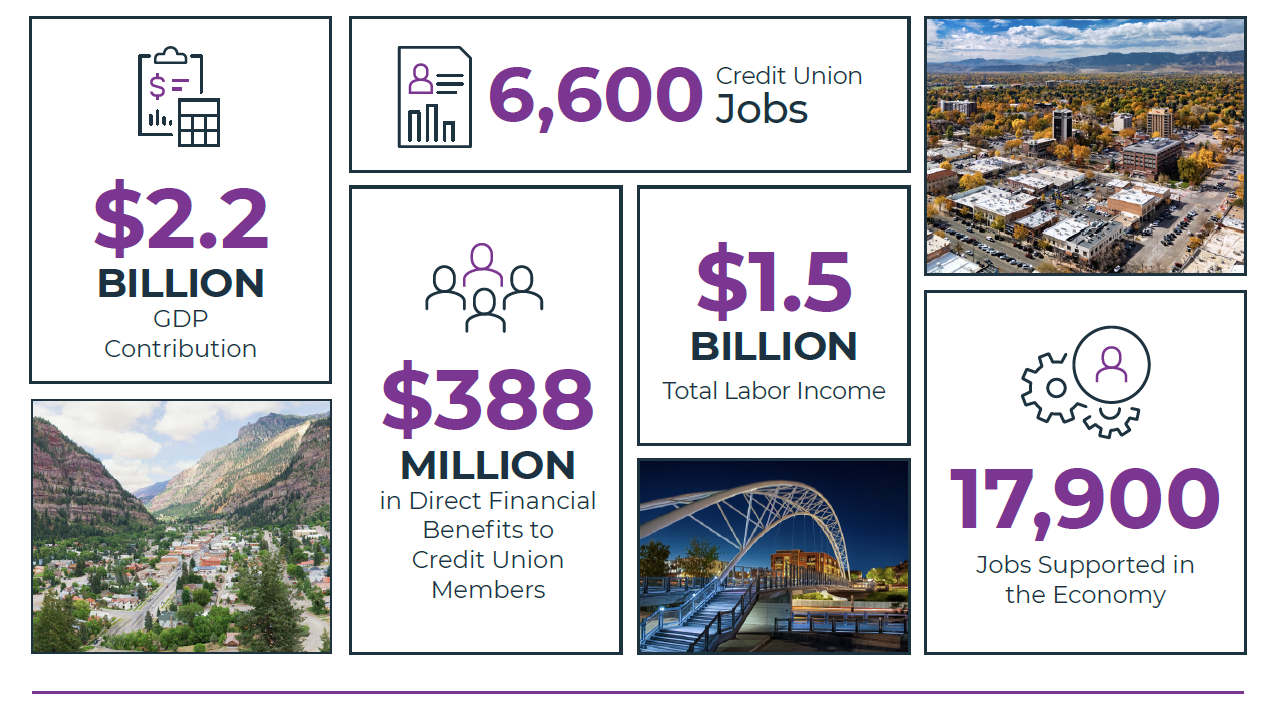

An independent analysis by Oxford Economics finds Colorado’s credit unions are essential to the economy.

Committed to the Community:

A Legacy of Helping People

Credit unions were founded by working-class consumers.

An analysis of Colorado credit unions’ community support shows that their people-helping-people service legacy continues today. Across the state, they look out for Coloradans’ financial well-being, by providing financial education, giving back to the community, helping their members to save for a brighter future, and by making the loans that help them afford life.

An analysis of Colorado credit unions’ community support shows that their people-helping-people service legacy continues today. Across the state, they look out for Coloradans’ financial well-being, by providing financial education, giving back to the community, helping their members to save for a brighter future, and by making the loans that help them afford life.